INTRODUCTION

The World Health Organization (WHO) Framework Convention on Tobacco Control (FCTC) defines the tobacco industry as ‘tobacco manufacturers, wholesale distributors and importers of tobacco products’1. Most tobacco control research remains focused on the four transnational tobacco companies (TTCs) due to their global economic power2-4. However, this focus misses most of the actors involved in bringing tobacco from field to smoker. If these actors did not work in synchrony with TTCs then TTCs would not have such profitable supply chains5,6. Here we produce a narrative review to introduce these opaque aspects of the tobacco industry using supply chain mapping.

Supply chain mapping is common in the academic literature on global commodity chains7, global value chains8 and global production networks9 . Likewise, civil society, for example non-governmental organizations (NGOs) and activist groups, has used supply chain mapping to understand the impacts of companies’ business activities, otherwise obscured through a lack of transparency10. The contribution of supply chain mapping to efforts to understand industry impacts, hold companies to account for these impacts, and foster transparency and accountability is increasingly recognised11.

The objective of this study is to set an expanded supply chain agenda in order to provide insights into new potential avenues of work for tobacco control researchers and advocates, deepening as well as how profit and power is accrued and distributed among participants, our understanding of the reach of the tobacco industry into other sectors and occupations. The tobacco supply chain is complex and involves many processes, products, and actors not always associated with tobacco production. Identifying these complexities is an important step in designing future research, campaigns, and regulation aimed at controlling these activities.

METHODS

Academic literature in SCOPUS (extracted 23 April 2019) and Web of Science (extracted 19 July 2019) was searched using the terms: ‘supply chain’ AND ‘(tobacco OR ciga*)’. After excluding duplicates and articles prior to 2013, there were 69 articles reviewed. These included articles funded by the tobacco industry. We did not use these industry-funded articles for statistics or arguments that might be unreliable, but simply to identify actors and processes not widely available in tobacco research to date (i.e. this is a deliberate strategy to fill some missing gaps). This review was augmented by a review of advertisements and articles in tobacco industry journals in 2019 (Tobacco International: 4 issues, and Tobacco Journal International: 1 issue). Supplementary internet searches and a priori knowledge of supply chains were used to find further sources and aid understanding. In total, we found 230 contributors to the supply chain.

RESULTS

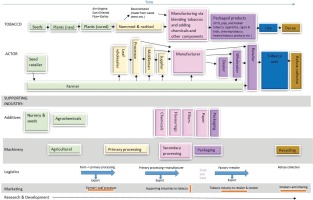

The tobacco supply chain can be understood in terms of its processes, the actors directly involved in production, and supporting industries. Figure 1 presents a visual overview of the tobacco industry in its entirety, laying the initial groundwork for future work in this area.

Processes

Tobacco exists as seeds, plants, cut tobacco, tobacco products, and refuse. The tobacco supply chain transforms tobacco through six major processes: farming, primary processing of the leaf, secondary processing into products such as cigarettes, product packaging, usage by smokers and decay. TTCs may directly own some elements and buy in components and expertise for others – the balance changes over time12. In some countries, parts of the supply chain are state-owned13.

Actors

Actors include seed and plant retailers, farmers, leaf processors, wholesalers, brokers and middlemen, manufacturers, retailers, smokers and refuse collectors (the last being funded through taxation or occasionally by tobacco companies if extended producer responsibility schemes are in place)14.

Farmers can purchase seeds or seedlings from retailers15,16. Tobacco can be grown in TTC or leaf company owned estates or by smallholder farmers17. Smallholders can hold contracts with a TTC or leaf company, where firms are contracted to buy the entire crop (although the price is not guaranteed18 making farmers’ profits volatile19), as well as provide agricultural guidance and inputs, usually via loans, such as seeds, fertilizers, herbicides, and pesticides, as well as transport to the next stage of the supply chain16,18-21. Such integrated production systems and incentives encourage farmers to choose to grow tobacco rather than other crops20.

Wholesalers acquire tobacco from the farmers either by contract or by auction, which they then either store in warehouses or export immediately21. Sometimes, primary processing is carried out by the wholesale leaf companies, other times by companies that also manufacture cigarettes; again tobacco can be exported at this stage20.

Supply chain intermediaries vary by place. In Java, for example, middlemen acquire primary processed tobacco and sell it on to ‘suppliers’22. In other parts of Indonesia and in India, brokers often buy tobacco from local collectors5,15,22 who then sell it on to major tobacco companies. These differences matter as closed and complex trading systems offer ample opportunity for parties to take advantage of farmers5. In other contexts, tobacco supply chains are more integrated and a single company may own not only the primary and secondary processing factories, but also the transport and storage facilities between them20.

Manufacturers create and package tobacco products such as cigarettes, chewing tobacco, cigars, pipe tobacco, roll-your-own tobacco and snuff21. To give a sense of the scale of these operations, in 2014, six trillion cigarette sticks were manufactured across 500 factories globally23.

The organization of intermediaries operating between manufacturers and retailers also varies by place. In China, for example, the manufacturer deals directly with retail24. In Pakistan, Bangladesh and Nepal, smokeless tobacco manufacturers supply ‘dealers’ who then deliver to wholesale retailers25. These wholesalers procure and sell products to vendors or retailers25 together with non-tobacco products21. Retailers sell the product to smokers25. Typically they include supermarkets, small grocers, convenience stores, and specialist tobacconists21.

Smokers are, of course, the end-product consumers, but they are not the final actors. Often forgotten are the refuse collectors disposing of tobacco products26. This is a significant externality of the supply chain and tobacco companies have mostly avoided being held responsible for these costs27.

Supporting industries

Supporting industries supply additives, machinery, logistics, marketing, and research and development (R&D).

Initial inputs include seeds produced by plant nurseries and farmers. The agrochemical industry supports tobacco farming through sales of fertilizer, herbicides and pesticides20,28.

Primary processing requires specialist machine and knife makers to work with the tobacco industry29-32, including makers of green leaf threshing machinery30, machines to add flavoring or the flavoring itself27, and specialist packing units for transit33,34.

Secondary processing requires machinery to make cigarettes29,30, oral tobacco35, hookah equipment35, cigars36,37, and packaging30. Again, this machinery requires specialist knives31,38,39 and chemicals40. In addition to tobacco and chemicals, cigarettes include paper and filters. Paper is provided by farmers growing flax, hemp, rice, sisal, and linen41. Tree growing and felling produces the pulp for both paper41 and filters42. Packaging companies provide the cartons, boxes, paper, ink, cellophane, foil, glue, and tins for the industry40,43-50.

Logistics includes storing and transporting tobacco and tobacco products51, but also making the equipment for printing serialized codes and other markers to trace products from source to final destination52-55.

Marketing takes different forms depending on client and audience. Often overlooked is how these firms market their products and services within the industry, such as when tobacco and leaf firms use marketing to attract and retain farmers. In Brazil, for example, this is via industry associations and the Tobacco Growers Union20. Supporting industries such as paper and machinery advertise in tobacco industry magazines56 and specialist firms can be brought in to market these products and others57. Tobacco manufacturers, including the TTCs, market their products to retailers via retailer magazines58 – and directly to end-users, unless legislation is enacted and upheld59. Of course marketing is also a key component of TTCs campaigns to avoid such regulation60.

Finally, each stage of the supply chain and supporting industry requires R&D22. Cigarette filters, for example, have received particular R&D attention since standardized packs legislation is limiting innovation via packaging61,62.

DISCUSSION

Clearly TTCs require support from a large number of actors and industries to bring products to market and secure their profits. Such an expanded understanding of the tobacco supply chain can be used to better inform governmental, corporate, civil society and laypersons’ choices about careers, investments, and purchases. It could also be used to inform evaluations of company claims around, for example, contributing to the Sustainable Development Goals63 or their corporate social responsibility practices64 and the extent to which such contributions are on balance advantageous in situations where a company is also working with the tobacco industry.

This preliminary analysis illustrates that to identify potential leverage points in these supply chains and design effective policy to influence them, research and campaigns need to look beyond the TTCs. However, future supply chains study will also need to consider carefully the best way to identify and use industry source materials to establish differences between these and other sources, and how information contained might be best used without compromising the integrity of the research.

While this supply chain mapping exercise is just a start, future research can build from this to, for example, understand the relative value capture for different actors at different stages of production, which can act as a proxy for who controls supply chain governance. Likewise, mapping supply chains onto political jurisdictions could identify further policy pressure points and gaps in research and regulation. For example, to date, much of the existing research on intermediate actors within the supply chain has taken place in Asia and future work in Africa and South America could help provide a richer picture. Note that future work in this area might consider an even more expansive notion of the tobacco supply chain. For example, while they did not come up in our review results, one could potentially include additional service providers as supporting industries, including those supplying legal services or those involved in government relations (i.e. lobbyists).

Supply chain mapping offers a strong grounding for further work aimed at countering tobacco industry arguments about the benefits of production. For example, while in some ways advantageous to all parties6, TTCs design supply chains to maximize their own profits at the expense of farmers65 and careful mapping can elucidate this asymmetrical distribution of profits. Additionally, supply chain mapping can expose otherwise hidden costs of tobacco production, for example its contribution to climate change23, deforestation40, and destruction of aquatic life66 or the ways in which the supply chain reduces global capacity for food and manufacturing of products that would promote human health and wellbeing67.

CONCLUSIONS

Bringing supply chain mapping to the attention of tobacco control can potentially aid the development of effective public health policy by identifying under-researched processes, actors and supporting industries, shedding light on the tobacco industry’s reach, and revealing new opportunities for regulation.