INTRODUCTION

Menthol is a characterizing flavor in combustible cigarettes and electronic nicotine delivery systems (ENDS). Through its sweet, cooling sensory effects, menthol facilitates the uptake of commercial tobacco products1. Menthol flavored e-liquids, specifically, are an understudied area of investigation. The U.S. Food and Drug Administration (FDA) 2016 Deeming Rule extends its regulatory authority to all commercial tobacco products, including e-liquids, and enforcement action against e-liquid advertisers who market to adolescents, an age group that is more likely to report flavors as a reason for ENDS use2,3. Additionally, evidence has shown that menthol and mint flavored e-liquids are appealing to adolescents4,5.

In February 2020, the FDA enacted a policy prohibiting flavored cartridge-based ENDS like JUUL nicotine pods, but still allowing for the sale of tobacco and menthol flavored cartridges6. Tank-style ENDS, also known as advanced personal vaporizers (APVs) and mods – which users can manually fill with e-liquids of their choice – were also exempt6. Many novel e-liquid flavors on the market now combine sweet flavors like fruit and dessert with cooling flavors comparable to menthol and mint7. These flavors are often marketed as ‘ice/iced/icy’ by ENDS manufacturers and may be appealing to adolescents7.

In the US, the ENDS marketplace has expanded in brick-and-mortar vape shops. Accounting for 30% of all ENDS sales8,9, it is estimated that during the past decade, more than 10000 brick-and-mortar vape shops have opened, dedicated exclusively to the sale of ENDS products10,11. Vape shops offer interactive customer experiences, including social interactions with vape shop retailers, who often also use ENDS12. Vape shop retailers serve as frontline consumer educators and play a significant role in marketing ENDs. This includes sponsoring social events to increase ENDS product acceptability13.

Vape shop retailers also help customers determine e-liquid flavors, nicotine levels, and they provide information on product use and safety14,15. Given the attractiveness in range of e-liquid flavors, it is critical that tobacco control researchers and regulators surveil and monitor marketing practices to gain insight, and inform public health and public policy. Brick-and-mortar vape shop websites can be used to capture and document the context in which consumers, including young users, are marketed these tobacco products. Yet, compared to menthol cigarette retail marketing16-18, cooling flavored e-liquid vape shop marketing is an understudied area of investigation. In this study, we examined cooling flavored e-liquid website marketing among brick-and-mortar vape shops in the Greater Los Angeles Area, to inform regulation of promoted flavored e-liquids that are available to consumers, and to inform the development of future tobacco control efforts.

METHODS

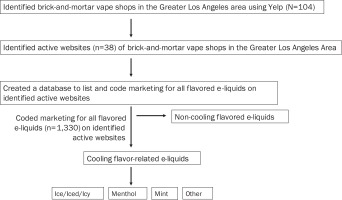

The data used in this study were publicly available via brick-and-mortar vape shop websites. The flow of the methodology used for our study is summarized in Figure 1. A total of 104 brick-and-mortar vape shops were identified in the Greater Los Angeles Area using ‘Yelp’14. A total of 38 of the 104 brick-and-mortar vape shops were found to have active websites at the time of data collection (28 September – 28 October 2020).

From each website, we collected marketing for all flavored e-liquids (photos/images), over a 30-day period. Only e-liquid bottles for refillable devices were selected for this study. We excluded pre-filled pod vapes and disposable vapes. If an e-liquid bottle was marketed in different packages, one package was randomly selected. The final dataset consisted of 1330 products. After identifying all marketed e-liquid flavor descriptors, menthol and mint flavor codes were based on standardized categories from prior literature19, with the addition of a code to capture ‘ice’ flavors. The menthol, mint, and ice categories represented any marketed e-liquid with an explicit menthol, mint, or ice/iced/icy flavor descriptor. When there was an e-liquid presentation of two or more codes (e.g. ‘Berry Mint Menthol’), it was coded as both mint and menthol. Further, if an e-liquid did not explicitly have a menthol, mint, or ice/iced/icy flavor descriptor but alluded to any cooling flavor (e.g. ‘Artic Air’, ‘Frozen Hulk Tears’), it was categorized as ‘other’. Two coders independently double coded 1330 photos/images across the coding period (1 February – 1 March 2021) to ensure reliability. The estimated intercoder reliability coefficient (Cohen’s kappa) was close to 1.00 (all above >0.90), with almost complete agreement between the two coders.

RESULTS

A total of 1330 unique e-liquid flavors were identified from 38 active websites. Of these, 219 were classified as either menthol, mint, or ice/iced/icy flavored e-liquids. As shown in Table 1, the largest category was ice (n=123; 56%), followed by menthol (n=32; 15%), and mint (n=23; 11%). Of the 123 ice-flavored e-liquids, 70.3% (n=83) were in combination with fruit (e.g. ‘Apple Ice’, ‘Grape Iced’, ‘Icy Mango’). Of the 32 menthol-flavored e-liquids, 63.3% (n=19) were in combination with fruit (e.g. ‘Dragon Fruit Menthol’, ‘Blue Raspberry Menthol’, ‘Fresh Peach Menthol’). A total of 41 cooling flavored e-liquids were classified as other (19%). These e-liquids were ‘concept’ flavors related to ice (e.g. ‘SUBZERO’, ‘Brain Freeze’, ‘Frozen Hulk Tears’, ‘Polar Breeze’).

Table 1

Percentages of cooling flavored e-liquids, coding definition, and example flavor descriptors per category

DISCUSSION

Principal findings

E-liquid marketing has proliferated on digital media, including websites that can have a profound reach to millions of individuals. This study presents a snapshot of cooling flavor descriptions of e-liquids for refillable ENDS marketed on the websites of brick-and-mortar vape shops in the Greater Los Angeles Area over the course of one month’s time in 2020. Key findings of our study are that more than half of the cooling flavored e-liquids examined in this sample were classified as ice/iced/icy, and more than half in this category were in combination with fruit. Menthol and mint flavored e-liquids were comparatively low.

Ice e-liquid flavors recently entered the US market. These ‘hybrid’ and ‘concept’ e-liquid flavors are not labeled as menthol. However, our study demonstrates that vape shops in the Greater Los Angeles Area are marketing a variety of menthol/mint/ice flavored e-liquids that produce cooling sensations. Menthol additives in e-liquids reduce the harshness and irritation associated with vaping nicotine19. The tobacco industry has a long history of using menthol additives to reduce the harshness of cigarette smoke and appeal to novice smokers20. An important subject for further study is to understand how vape shop marketing strategies for ice e-liquid flavors align with historic tobacco industry marketing strategies. Further, given that menthol additives in e-liquids are associated with an increase in appeal of ENDS in both adolescents and adults19, research on vape shop marketing for cooling flavored e-liquids is warranted.

Another primary finding of our study is that at least half of the e-liquids classified as ice and menthol were marketed as a combination of fruity and cooling flavors (e.g. ‘Apple Ice’, ‘Icy Mango’). It is unclear where these ‘hybrid’ e-liquid flavors fit into current regulatory frameworks, which apply restrictions according to distinct flavors21. At the same time, marketing for concept flavors such as ‘SUBZERO’ and ‘Brain Freeze’, pose a challenge for enforcement of flavored tobacco product restrictions. Our findings suggest that the public health implications of marketing for hybrid and concept cooling flavored e-liquids are an important subject for further study within this policy context and tobacco marketing landscape.

On 29 April 2021, the FDA announced that it will start the procedure to propose tobacco product standards to ban the sale of menthol cigarettes and all flavored cigars, including little cigars and cigarillos6. The agency noted that this is a step to ‘reduce addiction and youth experimentation, improve quitting, and address health disparities’6. Although the FDA noted that it will remain focused on its regulatory oversight of ENDS products, no official announcement was made to ban menthol in non-combustible products at the time of the press release6. Establishing a tobacco product standard that only allows tobacco or menthol-flavored e-liquid may result in an increase in vape shop marketing for cooling flavored e-liquids, including ‘ice’, and may impact consumer preferences. However, evidence is needed to address this possibility. Additionally, future research is needed to examine marketing for cooling flavored pre-filled pod-based and disposable device liquids.

Limitations

Our findings should be considered with some limitations. First, we focused on Greater Los Angeles Area brick-and-mortar vape shop websites only and excluded other brick-and-mortar vape shops, and Web-based channels that are used to market nicotine and tobacco products, including social media. Second, data reflect cooling flavored e-liquids marketed at specific moments in time and may not be fully generalizable to websites of other brick-and-mortar vape shops.

CONCLUSIONS

Research on marketing for cooling flavored e-liquids is scarce, and even less known are the marketing practices of vape shop retailers. Our results underscore the need for continued research and surveillance on the cooling flavored e-liquid content that is currently being delivered via vape shop websites. Brick-and-mortar vape shops in the Greater Los Angeles Area are marketing a variety of cooling flavored e-liquids on their websites. Such marketing focused largely on ‘ice’ fruit flavor combinations (i.e. fruit and menthol combination). Characterizing vape shop retailers’ marketing strategies may provide evidence for policies aimed at ENDS marketing regulations. Future research is needed to understand how exposure to and appeal of cooling flavored e-liquid marketing on vape shop websites differs among diverse consumer groups, including, adult menthol cigarette smokers and non-smoking youth.

CONFLICTS OF INTEREST

The authors have completed and submitted the ICMJE Form for Disclosure of Potential Conflicts of Interest and none was reported.

FUNDING

This research was supported by the National Cancer Institute and the Food and Drug Administration’s Center for Tobacco Products (Smiley, Principal Investigator: NCI Research Supplement to Promote Diversity in Health-Related Research under U54CA180905, Pentz/Leventhal, Co-Principal Investigators). The content is solely the responsibility of the authors and does not necessarily represent the official views of the NIH-NCI or the FDA-CTP.

ETHICAL APPROVAL AND INFORMED CONSENT

Ethical approval was obtained from the University of Southern California Institutional Review Board (HS#19-00827; Date: 11 November 2019). Informed consent was not required as publicly available data were used.