INTRODUCTION

Globally, tobacco use is the leading cause of preventable death. Worldwide, the number of youth aged 13–15 years who smoke cigarettes is estimated to be about 25 million, with almost 13 million using smokeless tobacco products1. Tobacco-related illnesses and premature mortality devastate the economies of nations because of sickness and death within the workforce. This scenario is severe, particularly among highly populated low- and middle-income countries, as tobacco use is high in those areas2.

Tobacco taxation is the most effective way to prevent and reduce tobacco use. A sufficiently large tax increase will raise tobacco product prices, making tobacco products less affordable, driving down their consumption among those who continue to use them3. Further, the revenue generated through taxation can provide much needed funding for tobacco control programs. However, all the tobacco products are not taxed in the same manner or same rate4. Tobacco tax parity refers to the idea that taxes on smokeless tobacco products should be increased to be on par with the tax rates imposed on cigarettes so that countries do not lose their revenues when smokers switch from cigarettes to other cheaper tobacco products.

Several countries enforce differential taxes based on the characteristics of cigarettes and other tobacco products. Previously, the United Kingdom imposed differential taxes on cigarettes based on tar and nicotine content. However, this differential taxation may be prone to tax avoidance5. The tobacco industry might alter an attribute of a brand, such as retail price, that consequently reclassifies the brand into a lower tax bracket. This phenomenon was observed in Egypt, where an international brand dropped its price just enough to be reclassified into a lower tax bracket5,6.

Historically, smokeless tobacco products have been taxed at much lower rates than cigarettes, even though they are essentially the same thing and their use carries similar health risks. Many jurisdictions are in the process of modernizing their tobacco tax statutes, to ensure that smokeless tobacco products are not under-taxed7,8. The underlying concern is that, in the face of rising cigarette excise taxes, smokers may turn to lower priced alternatives (smokeless tobacco products) rather than quit9. Thus, tax increases need to be applied symmetrically across all types of tobacco products in a manner that equalizes their retail price, so that consumers will not turn away from relatively high-priced products towards those with lower prices.

Little information and updates on smokeless tobacco indicators are available from the World Health Organization (WHO) Framework Convention on Tobacco Control (FCTC) Convention Secretariat’s Global Progress Report on implementation of the FCTC, WHO Report on the Global Tobacco Epidemic, and the WHO FCTC Global Knowledge Hub on Smokeless Tobacco. Moreover, information on smokeless tobacco control measures is inadequate or not available from several countries. Hence, this study aimed to identify the total tobacco tax disparity among countries that are Parties to the WHO FCTC agreement.

METHODS

A cross-sectional study was conducted among the signees of the World Health Organization Framework Convention on Tobacco Control treaty. Secondary or published data regarding the country profile, taxation on smokeless tobacco (SLT) products and cigarettes were drawn from different sources such as the Global WHO FCTC Implementation progress reports 2017 and 201810, WHO reports on the global tobacco epidemic 201911 and additionally tobacco control legislation and regulations that were available in English. The trends of taxation on cigarettes and smokeless tobacco products were retrieved from the abovementioned sources. The compiled data were entered in Microsoft Excel spreadsheet and analyzed using Statistical Package for Social Sciences (SPSS) software version 21.0. The median tax percentages were then compared based on the economic status and WHO regions of the countries, using the non-parametric Kruskal Wallis test. A p-value <0.05 was considered significant statistically and adjusted pairwise comparison was done for the significant variables.

RESULTS

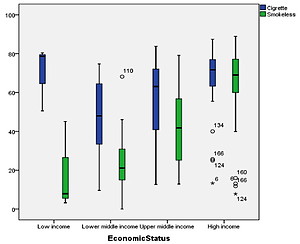

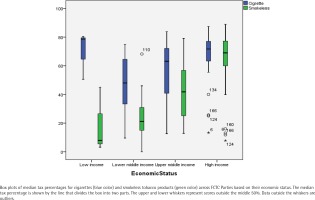

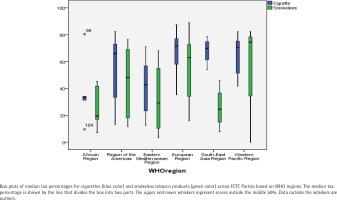

The results show that taxes were higher on cigarettes than smokeless tobacco products among all the FCTC Parties classified by income. However, this difference was statistically significant only among low income, lower middle-income, and upper middle-income countries (p<0.001) (Figure 1). Similarly, taxes on cigarettes were higher compared to smokeless tobacco products in all the FCTC Parties classified by WHO regions. This difference was statistically significant in the South-East Asia region (p<0.001), Eastern Mediterranean (p=0.043), Western Pacific (p=0.038), and African regions (p<0.001) (Figure 2).

Figure 1

Comparison of tobacco taxation between cigarettes and other tobacco products across FCTC Parties based on their economic status

Figure 2

Comparison between cigarette and smokeless tobacco taxation among FCTC Parties in WHO regions

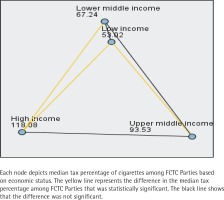

We analyzed the difference in cigarette taxation between various FCTC Parties based on their economic status. It was found that the median tax percentage on cigarettes was maximum among high-income countries (71.8), followed by upper middle-income (54.1), lower middle-income (41.2), and low-income countries (36.75). This difference was found to be statistically significant (p<0.001) (Table 1). The pairwise comparison shows a statistically significant difference in cigarette taxation between low income and upper middle-income countries; low-income and high-income countries, and lower middle-income and high-income countries (p<0.05) (Figure 3).

Table 1

Difference in cigarette and smokeless tobacco taxation between the countries based on their economic status

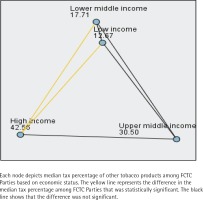

It was found that the median tax percentage on smokeless tobacco products was highest among high-income countries (69.0) followed by upper middle-income countries (41.8), lower middle-income countries (21.1), and least among low-income countries (7.9) (p<0.001) (Table 1). The pairwise comparison of the same shows a significant difference in smokeless tobacco taxation between low-income and high-income countries and lower middle-income and high-income countries (p<0.05) (Figure 4).

Figure 4

Pairwise comparison of taxation on other tobacco products among FCTC Parties based on economic status

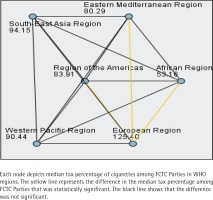

Comparison based on the WHO region revealed that the median tax percentage for cigarettes was significantly higher for the European region (73.8) followed by South-East Asia (63.25), Eastern Mediterranean (56.4), Western Pacific (54.15), the Americas (49), and African regions (37.3) (p<0.001) (Table 2). Pairwise comparison of cigarette taxation based on WHO regions shows a statistically significant difference in cigarette taxation between the African and European regions, Eastern Mediterranean and European regions, and region of the Americas and European region (p<0.05) (Figure 5).

Table 2

Difference in cigarette and smokeless tobacco taxation between various WHO regions

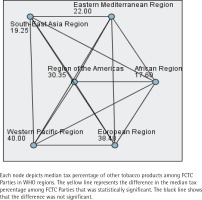

It was found that median tax percentage on smokeless tobacco products was maximum in the Western Pacific region (74.4), followed by the European (62.95), the Americas (48.1), Eastern Mediterranean (29.25), South-East Asia (24.6), and African regions (19.5) (p=0.034) (Table 2). Pairwise comparison of smokeless tobacco taxation among FCTC signees shows no statistically significant differences based on WHO regions (Figure 6). Further details are given in the Supplementary file.

DISCUSSION

Parties’ implementation of taxation on smokeless tobacco products lags in comparison to cigarettes. Additional attention toward smokeless tobacco is as important as taking continued measures against smoking. The fact that taxes for smokeless tobacco are way lower than those of cigarettes could be attributed to the relatively low cost of smokeless tobacco products. Lower taxes contribute to the increasing affordability of smokeless tobacco products12. Recently in many developed countries, a substantial number of price-conscious smokers of factory-made cigarettes (FM) are encouraged to self-assemble cigarettes by hand or roll-your-own tobacco (RYO) to reduce the cost of smoking13. Hence, increased taxation on other tobacco products (RYO and SLT) would address their relative affordability, especially if it resulted in comparable costs to other tobacco products or factory-made cigarettes.

Studies from low-income and lower middle-income countries reveal that with a significant increase in tax, the consumption of smokeless tobacco products is reduced14,15. Similarly, a study from four high-income countries also shows that consumers from the countries where tobacco taxes are higher (UK and Australia) reduced the amount of tobacco in their RYO cigarettes compared with those from USA and Canada where tobacco taxes are lower16.

Though the World Health Organization (WHO) recommends that tobacco taxes must account for at least 70% of the market price of tobacco products17, only 54 and 15 Parties had implemented the recommendation on cigarette and smokeless tobacco products, respectively. Simply put, taxation as a regulatory tool against smokeless tobacco use is highly underutilized among most Parties, even though the adoption of the taxation is highly feasible. Contrary to the assessment of the impact of tax increases in reducing cigarette demand, the documentation concerning the impact of increases in smokeless tobacco taxation is inadequate. Few studies have assessed the effectiveness of tax increases on the demand for tobacco products other than cigarettes14-16.

To discuss price equity and tax equity, we need to understand the concept in three different views. First, according to manufacturers of tobacco products, the manufacturing of cigarettes requires more time and resources compared to smokeless tobacco. Hence, the price of the products varies based on the investment in the manufacturing of the product18. Second, although there is no safe way to indulge in tobacco use, many economists find that smoking might have a greater impact on the population. Also, when it comes to smoking cigarettes there is always the risk of secondhand smoke to others who do not smoke, which in turn increases the government expenditure to treat smoking-related diseases19. Third, according to public health personnel, increasing taxes alone might lead to dual use or an increase in smokeless tobacco use in countries with a high prevalence of smoking. Hence, in those countries, it is important to emphasize price equity along with tax equity. On the other hand, in low-income countries and countries with high smokeless tobacco prevalence, tax equity would serve the purpose.

FCTC Article 6 advocates that any tax increase introduced for cigarettes should also be applied to smokeless tobacco products to avoid substitution20. Given that smokeless tobacco consumption is a global burden, particularly in Asian countries, we recommend that the Parties to the FCTC adopt continuous monitoring of the implementation of taxation policy for smokeless tobacco control. Taxation on all kinds of tobacco products, without any exceptions, should be considered as the need of the hour. Smokeless tobacco products can also be categorized separately and taxed differently under state tobacco tax codes.

CONCLUSIONS

There is a disparity in tobacco taxation among FCTC Parties and the parity differs based on the economic status and WHO region of the countries. Also, smokeless tobacco products were highly under-taxed compared to cigarettes. Hence, tobacco control advocates should continue to support the imposition of higher tobacco taxes. They should also promote tobacco tax equity, to ensure that smokeless tobacco products are taxed at the same rate as cigarettes. We also recommend that countries that are already taxing tobacco products at 70% should further increase the rate over time, taking into account inflation and income changes, to ensure that tobacco products become progressively less affordable.